What is Cat Insurance?

Cat insurance covers the costs of treating your cat’s unexpected injuries and health issues. It can be a lifesaver for your pet and wallet if your furry family member needs veterinary treatment. While we never want to think about our pets ever needing serious veterinary care, it’s more likely than not that they might need it. 2 out of 3 pets experience a significant health problem during their lifetime. Enrolling in a pet insurance plan for cats is one of the best ways to ensure you have the resources to pay for big, unexpected vet bills.

Benefits of Cat Insurance

If you’re wondering if cat insurance is worth it, the short answer is it depends. If your cat develops health issues or has an accident where you need to use the insurance, you’ll be happy to have it.

If you never need to use it, you just paid for peace of mind, which is one of the many reasons pet parents sign up for cat insurance. Here are some more:

Financial Security

You already budgeted for unexpected health issues so you can have peace of mind.

Freedom of Choice

You can take your cat to any licensed vet, clinic, or hospital without restrictions.

Breed-Specific Expenses

You can save on vet bills for specific conditions certain cat breeds might develop.

What Does Cat

Insurance Cover?

Standard cat insurance plans cover accidents and illnesses ranging from surgery to remove a swallowed hair tie (which happens more than you might think) to comprehensive cancer treatment. Here is a more detailed breakdown of what a standard plan covers.

Accident and Illness Coverage

Accident and Illness Coverage

Pet insurance will not, for example, cover pre-existing conditions. This means if you are attempting to sign up for insurance after your pet has become ill or injured, the insurer will not pay any claims that are associated with that specific ailment.

Accidents |

Illnesses |

X-Rays, Blood Tests, etc. |

Surgery |

Hereditary Conditions |

Hospitalization |

Congenital Conditions |

Prescription Medications |

Chronic Conditions |

Emergency Care |

Cancer |

Specialty Care |

Diagnostic Treatment |

Alternative Treatment |

*Unless you add a separate wellness plan |

Wellness Coverage

Wellness Coverage

If you’re looking to be reimbursed for preventative and routine care, some insurers offer an optional wellness coverage add-on.You can add this to your cat insurance plan to cover annual exams, vaccines, dental cleanings, and more to keep them healthy between vet visits. Wellness coverage varies by insurer, so always check sample policies and compare wellness plans to see which is best for you. In this table, see a breakdown of what a typical wellness plan covers.

Annual Exams |

Blood Tests |

Vaccinations |

Microchip |

Health Certificate |

Behavioral Exam |

Heartworm Tests |

Urine Tests |

Deworming |

Fecal Test |

Spay/Neuter |

Preventative Care |

Dental Cleaning* |

Alternative Treatment |

*Varies by insurer |

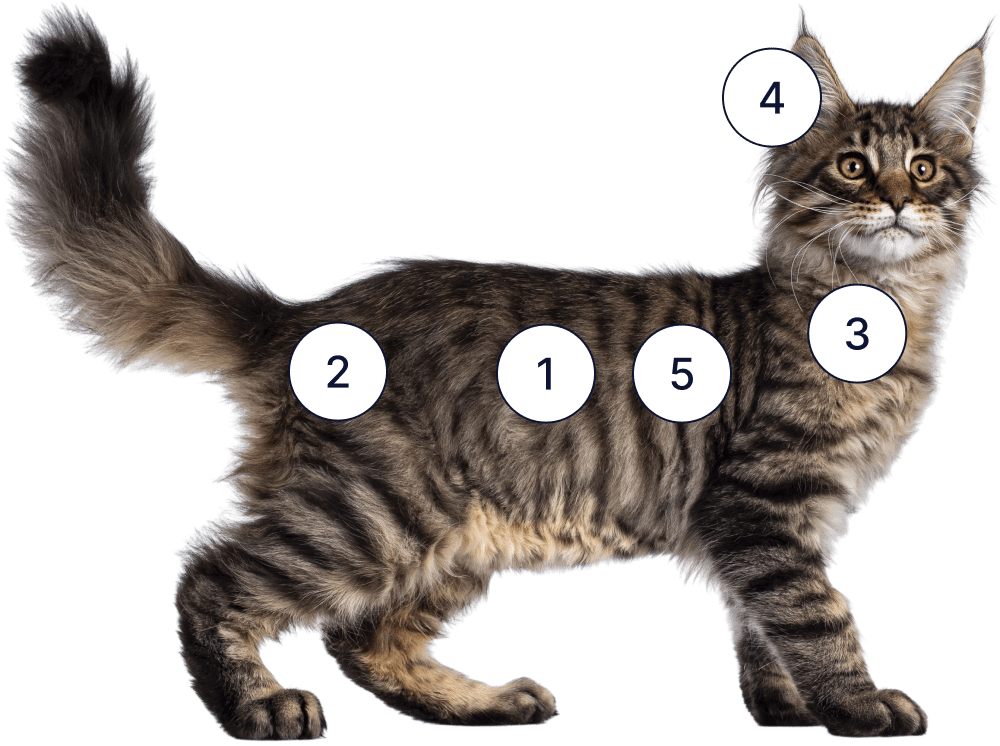

Common Reasons Cats Visit the Vet

According to claims data from Healthy Paws, pet parents spent over $523 million in 2023 on accident and illness veterinary care.

Here are some of the top reasons cats were visiting the vet:

That’s just data from one pet insurance provider. Many things could land our cats in the vet’s office. Enrolling in cat insurance can help prepare your cat for whatever life has in store, including any breed-specific or other cat-specific health conditions they might develop in their lifetime.

How Does Cat

Insurance Work?

Cat insurance works similarly to how health insurance for people works. And we enroll in them for the same reasons: peace of mind and support for unexpected medical bills. You know how it goes, we get sick or find ourselves hurt in an accident then visit a hospital, emergency room, or urgent care. If we’re enrolled in health insurance before receiving care, we’ll file a claim with our insurance provider, and they will cover up to a certain amount of eligible medical costs.

With cats, there aren’t any veterinarian restrictions or in-network care providers that pet insurance companies work with, so there’s more freedom of choice with cat health insurance than human health insurance. So, if your cat is enrolled in cat insurance before they get sick or hurt, they can visit any vet and receive the care they need.

Most pet insurance companies work on a reimbursement model. This means that at checkout, you’ll cover the bill. Then, you’ll submit a claim to get reimbursed for covered costs. You’ll have a window of time to file a claim before it expires. Some insurers require you to file a claim within 90 days after treatment, while others allow you to file at any time during the coverage period of your policy. Always check your policy details to know when your claims expire.

Some pet insurance companies pay the vet directly, meaning you don’t have to worry about paying for services at checkout. This method also saves you time from filing a claim and waiting to be reimbursed.

Decoding Common Cat Insurance Terms

Annual Limit

This is the maximum amount your insurance policy will pay for covered veterinary expenses within a single year. Consider this limit when choosing a plan to ensure your pet's healthcare needs are adequately covered throughout the year.

Claims Expiration

This is the amount of time you have to submit a claim with an insurance provider to get reimbursed for covered costs. It varies by insurer.

Co-Insurance

Sometimes called 'reimbursement rate,' this is the percentage that your pet insurance provider will reimburse you for the total cost of eligible conditions treated by a veterinarian after your deductible is met.

Deductible

This is the amount you will pay out of pocket for veterinary expenses before your insurance coverage kicks in. Choosing the right deductible helps balance your monthly premium and potential out-of-pocket costs, ensuring your pet's health is protected without straining your finances. Most deductible options that insurers offer can be as low as $0 or as high as $1,000. In some cases, the deductible can be configured.

Direct Billing

Sometimes called Direct Vet Pay, the insurance company pays the veterinarian for eligible pet medical expenses. This process spares the pet owner from paying the entire bill upfront and seeking reimbursement later.

Monthly Premium

This is the monthly fee you pay for pet coverage. Your monthly premium will go up as your pet ages.

Reimbursement Rate

Sometimes called 'co-insurance,' this is the portion of your eligible veterinary expenses that your insurance provider pays you back after you've met your deductible. This percentage determines how much of your vet bills will be covered by your insurance plan. Most insurers have options between 70% and 90%.

Sub-Limits

This is the maximum amount an insurer will pay for certain coverage or conditions within a policy period. This helps them manage risk and keep premiums affordable. Sub-limits vary by insurer (and not all companies have them), so always be sure to read sample policies closely for these limits.

Read our full list of pet insurance terms and definitions for more.

Is Cat Insurance Worth It?

Let’s say your kitty is playing with your unattended knitting project. They gnaw on it and end up swallowing the yarn. Unfortunately, a cat that swallowed yarn is a common event in a vet's office. Sometimes, cats can pass ingested objects on their own but in some cases, they need surgery.

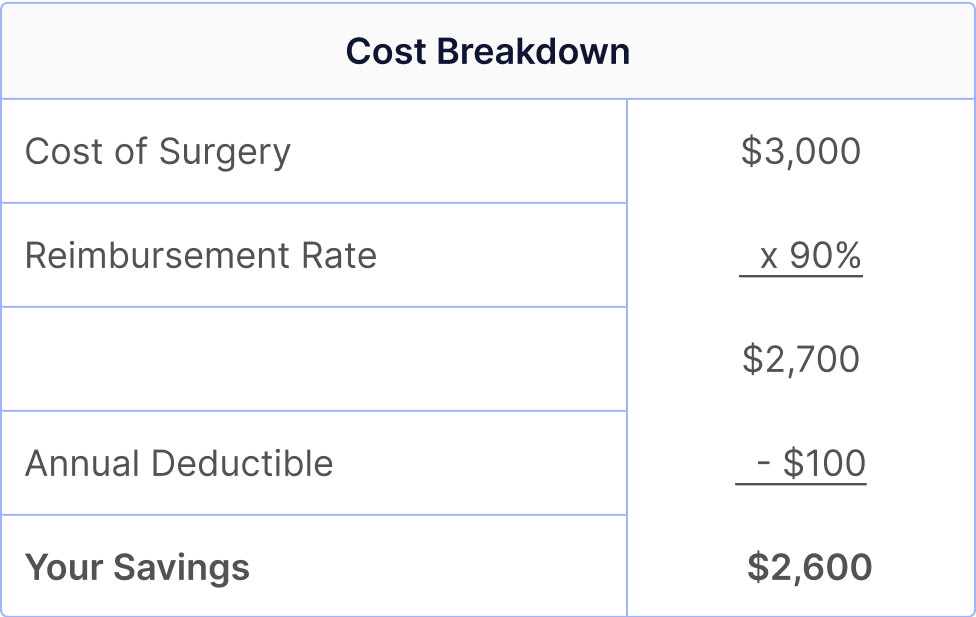

The good news is that most cats that have surgery recover and go on to live happy and healthy lives. But the bad news is that you’ll be looking at a $3,000 vet bill at checkout. Here’s what that bill would look like if you were enrolled in a pet insurance plan with a 90% reimbursement rate and a $100 annual deductible.

So if your cat is insured you would save $2,600 on one health scare for your kitty, isn’t that worth the cost?

Cat Insurance Can Help You Budget for Healthcare

Paying for pet insurance is kind of like a budgeting tool. You’re essentially contributing to the cost of potential healthcare for your pet over the term of the policy (whether it’s monthly, annually, or otherwise). If you don’t have health insurance, you’ll likely have vet costs at some point - and they could be more expensive than you think. Having pet insurance helps lessen the shock of an expensive vet bill since you’ve been putting money toward your pet’s healthcare over time.

What Are Waiting Periods?

In pet insurance, a waiting period is the amount of time you will need to wait for your coverage to become effective. It also indicates how long you’ll have to wait to file claims for your pet’s healthcare expenses.

Here are a few waiting periods you’ll see across pet insurance providers.

You just enrolled your cat in a pet insurance plan with a 3 day waiting period for accident coverage. Let’s say you’re gifted a bouquet of lilies by a friend 1 day after you signed up for your plan. You’re unaware they’re toxic to cats and bring them home – your curious cat eats some of the petals when you’re not looking. The insurance won't cover the veterinary expenses for treating that injury since it would’ve fallen within the 3 day accident waiting period. So if you take your cat to the vet for treatment, no costs will be covered.

Accident Waiting Period

This refers to the amount of time after enrolling your cat in a pet insurance plan that coverage for accidents is not provided. Accident waiting periods can range from 0 to 15 days, but always check your policy for details.

You just enrolled your cat in a pet insurance plan with a 14 day waiting period for illness coverage. Let’s say your cat develops a skin infection 9 days after you signed up for your plan. The insurance won't cover the veterinary expenses for treating your cat’s skin infection since it would’ve fallen within the 14 day accident waiting period. So if you take your cat to the vet for a sick visit, no costs will be covered.

Illness Waiting Period

This refers to the amount of time after enrolling your cat in a pet insurance plan that coverage for illnesses is not provided. Most pet insurance companies have a waiting period of 14 days, but always check your policy for details.

Let’s say you enroll your cat in a wellness plan with your current insurer, and the waiting period for routine and preventative care coverage is 1 day. You take them to the vet for a routine check-up to get vaccinated the same day, the insurance company won't cover the costs of that visit since it happened during the 1-day waiting period.

Wellness Waiting Period

This refers to the amount of time after enrolling your cat in a pet insurance plan that coverage for routine and preventative care is not provided. Typically, most insurers don’t have a waiting period for coverage, which means it could be effective immediately upon purchase.

Let’s say you have an adventurous cat who loves exploring the outdoors. On one of their outings, they injure their hind leg after jumping from a high ledge while chasing a bird. When your kitty comes home, you notice they’re limping so you take them to the vet. The cat insurance plan you’re enrolled in has a 6 month waiting period for orthopedic coverage and it’s been 4 months since you signed up for the plan. Unfortunately, the treatment for your cat’s accident will not be covered since it happened during the waiting period. That means you’ll have to pay for the surgery and all related costs to the accident yourself.

Orthopedic Waiting Period

This refers to the amount of time after enrolling your cat in a pet insurance plan that coverage related to orthopedic conditions or injuries is not provided. Orthopedic waiting periods can range from 14 days to 12 months, but always check your policy for details. Plus, some pet insurance companies offer special conditions or waivers for the orthopedic waiting period, so be sure you fully understand your policy’s terms and conditions if this is important to you.

When Should I Get Cat Insurance?

Most insurers have a minimum enrollment age between 6 and 8 weeks old, but you can enroll a cat in pet insurance at any stage of their life. We recommend signing up for cat insurance when they’re young and healthy.

It’s important to know that regardless of the age of your pet when they were originally insured, the price of coverage will rise as it gets older. Let’s dig into the benefits of pet insurance for kittens.

Benefits of Kitten Insurance

Getting cat insurance when your kitten is young helps set them up for the best coverage possible that can help pay for veterinary treatment when your cat gets sick, injured, or develops unexpected health issues.

Here are the top reasons to sign a kitten up for pet insurance:

Ensuring treatment for hereditary conditions if your kitten is diagnosed with one later.

Younger pets cost less to insure. Getting coverage now can save you big rather than signing up when they’re older.

Pre-existing conditions aren’t covered. Enrolling your kitten early and getting a clean bill of health from the vet means any covered conditions they didn’t show signs of before are eligible for coverage.

Kittens are curious and love exploring, making them prone to accidents, like eating something they shouldn’t. Pet insurance, like any insurance, provides peace of mind for the unexpected.

Emergency veterinary care can cost thousands of dollars. Most cat owners don’t realize how expensive an emergency visit is until they’re faced with the bill or, in some cases, a hard decision to make at the veterinary hospital.

Tip:

Adding wellness coverage to your kitten insurance is a great way to round out your young cat’s protection.

During the first few years of their lives, you’ll probably visit the vet more often for exams, vaccines, or even a spay or neuter. The routine and preventative care that comes with wellness coverage can help cover the costs for all these things and more.

What Is The Best Pet Insurance For Cats?

Whether you have an 8-week-old kitten or a 5-year-old cat, you’ll have many cat health insurance options to explore. We recommend getting a pet insurance plan that covers accidents and illnesses in their base plan with the option to add wellness coverage. With any plan, regardless of insurance provider, you should lean into a coverage configuration that works best for you and your pet. Here’s our recommended configuration for a plan that covers accidents and illnesses with optional wellness coverage. If you’re able to configure your plan, that’s a plus. Here’s our recommended configuration for a plan that covers accidents and illnesses with optional wellness coverage.

Annual Limit

$10,000

This limit provides substantial coverage for accidents and illnesses without being overly costly for you or the provider.

Deductible

$300

This deductible is balanced and encourages some cost-sharing while still ensuring accessibility to care for most pet parents.

Reimbursement Rate

80%

This rate is balanced and covers most of the costs by the provider while fostering financial responsibility on your end.

Ready to start your pet insurance search? You can check out our top picks for the best cat insurance or get a quote to compare multiple insurers below.

Compare QuotesCat Insurance

Frequently Asked Questions

-

Is my cat’s breed eligible for coverage?

Yes! All cat breeds in all states are eligible for pet insurance coverage. The key is to enroll while your cat is young and healthy because pet insurance does not cover pre-existing conditions and the cost is lower for younger cats.

-

Can a cat of any age enroll in a pet insurance plan?

It depends on the provider. Most providers require your cat to be eight weeks old during sign-up. Some also have upper age limits for specific coverage.

-

Is pet insurance worth it for a senior cat?

The peace of mind that comes with pet insurance is invaluable. As your cat ages, the need for veterinary care will increase, and senior pet care can be especially costly. Insurance may help make medical care more affordable. But, conditions your older cat has when you enroll them in a new pet insurance plan are considered pre-existing, and will likely not be covered. You can compare plans to see if cat insurance is best for your older cat.

-

How much is pet insurance for a cat?

The short answer is, it depends. A few factors determine how much you will pay for pet insurance: type of pet (like cat, dog, or exotic), breed, where you live, your pet’s age, your pet insurance provider, and the kind of coverage you choose.

-

How much does a vet visit cost without cat insurance?

It depends on the cost of veterinarian care in your area and the type of treatment received. But as an example, let’s say you visit an emergency vet after your cat has eaten something toxic. The total cost of your visit could range from $200–$2,0001, depending on the type of toxin ingested and your cat's treatment.

1 According to Money.com.

-

How can I compare different pet insurance plans and companies?

Using our free platform is the quickest (and easiest) way to get quotes from multiple pet insurance providers to compare plans. Fill out a quote form and we’ll simplify your search by pulling recommended plans from trusted providers. From there, you can compare your best options, all in one place.